Trading Futures in the US. Is It Really Banned?

Every professional trader strictly adheres to the trading strategy, calculates the risk-profit ratio, and carefully analyzes all the opportunities the market provides. He buys assets, engages in margin trading and gradually develops, approaching one of the most lucrative and profitable areas – futures contracts.

Futures really occupies the best place in every trader's wallet, because he gets many attractive advantages of this type of trading:

- Access to a wide range of cryptocurrencies without having to own them.

- The ability to buy or sell at a pre-planned price at a pre-arranged time.

- Hedging the risks associated with constant changes in the price and market situation.

- The ability to profit from changes in the price of an asset (isn't it the main point of trading?).

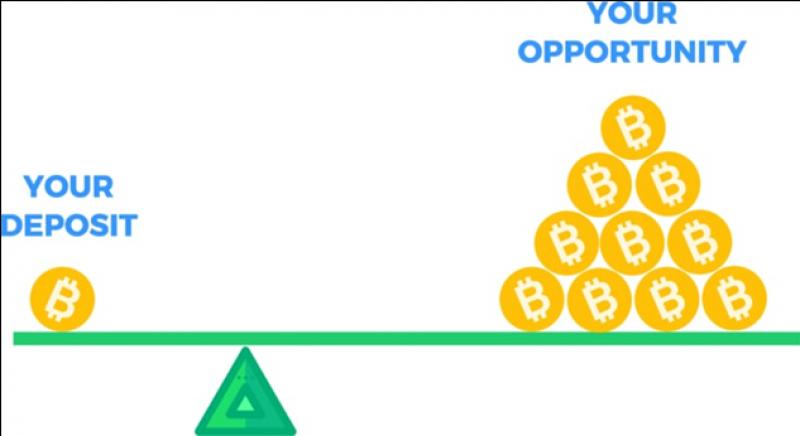

- Huge leverage (up to x125), allowing you to increase your profit many times.

- Low commissions when trading altcoins (note for scalpers).

After such an analysis of all the advantages of futures contracts, of course, the trader puts them on his agenda, analyzing the market and adapting his strategy. But next he encounters a major problem – he is in the United States.

The U.S. is a country of opportunity for many, especially for crypto traders, because it is a state where both cryptocurrency is legalized and the country guarantees complete security for this sector. And in this case, regulators decided that security is first and foremost about reducing risk, so exchanges offering derivatives trading are banned and remain without a license. Unfortunately, this step provoked popular exchanges to leave the region or limit the number of offered products.

But any respectful trader will not be able to give up the leverage х125, the possibility to implement their strategy to the maximum and do trading taking into account all possibilities of this sphere. Therefore, we will tell and show you how to enter the futures market, with a few steps and a couple of secrets.

- Evaluate the crypto futures market, identify projects that are interesting to you.

- Study the principles of market capitalization, adjust your trading plan, and learn the experience of knowledgeable traders.

- Think about risk management.

After this proceed with registration on the exchange. Follow this link to find a detailed explanation of all registration steps to help you use the exchange from ANY part of the world. BikoTrading has been engaged in professional trading for 8 years, knows all the secrets of this industry and is ready to share experience in proper selection, connection and setting up of the exchange. Check the article and in a couple of minutes you will enjoy trading in futures even if you are in the US. This little instruction will help you quickly connect and set up an exchange on your phone and computer.

Despite U.S. restrictions and bans, it's a safe and effective way to use futures trading. More than 6 million traders are registered on this exchange, actively trading, using low commissions and increasing their deposit several times over. So why pass up such a chance?

More to Read:

Previous Posts: